Cobinhood vs PrimeXBT

Choosing the right trading platform is essential for successful cryptocurrency trading. Cobinhood and PrimeXBT are two notable platforms, each offering unique features and advantages. This article provides an in-depth comparison of Cobinhood vs PrimeXBT, covering various aspects such as trading options, fees, security, and user experience. By understanding these factors, traders can make an informed decision about which platform best aligns with their trading strategies and goals.

Introduction to Cobinhood and PrimeXBT

Cobinhood and PrimeXBT have made their mark in the cryptocurrency trading industry by offering distinctive features tailored to different types of traders. Cobinhood is known for its zero-fee trading model, making it an attractive option for cost-conscious traders. PrimeXBT, on the other hand, is renowned for its advanced trading tools, high leverage options, and diverse range of trading instruments including cryptocurrencies, forex, commodities, and indices.

Understanding the core offerings of each platform is crucial for selecting the one that best suits your trading needs. This comparison will delve into the detailed features, fee structures, security measures, and user experience provided by Cobinhood and PrimeXBT.

- Cobinhood: Known for zero-fee trading, a variety of cryptocurrencies, and user-friendly interface.

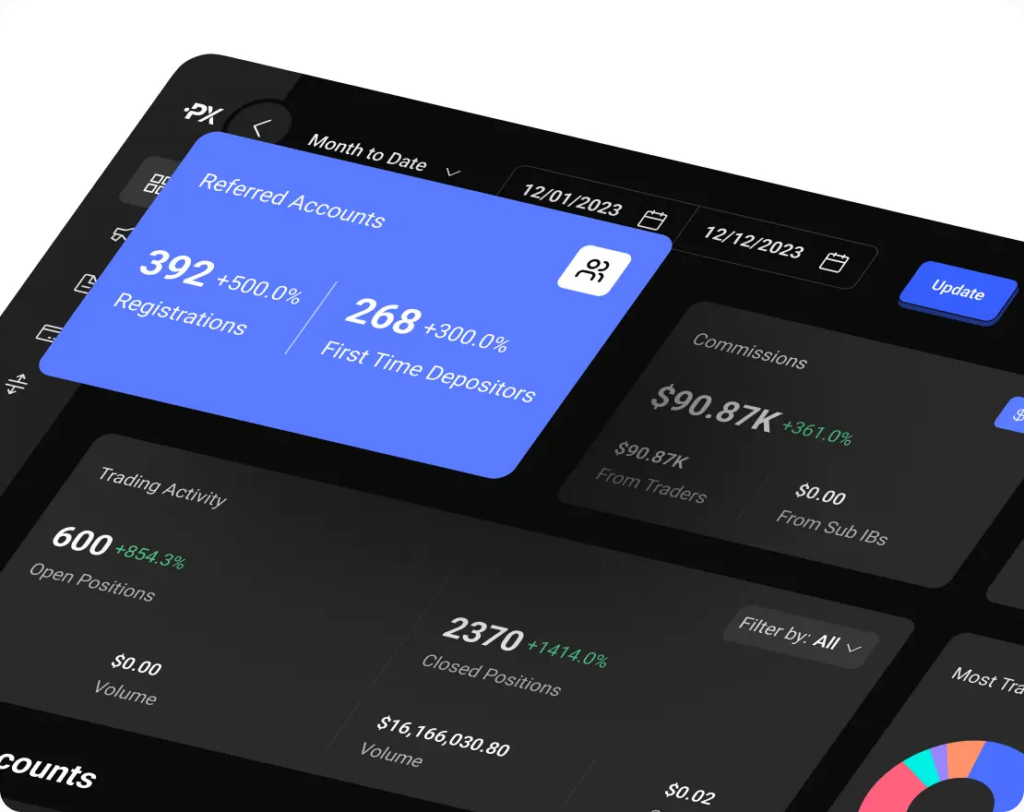

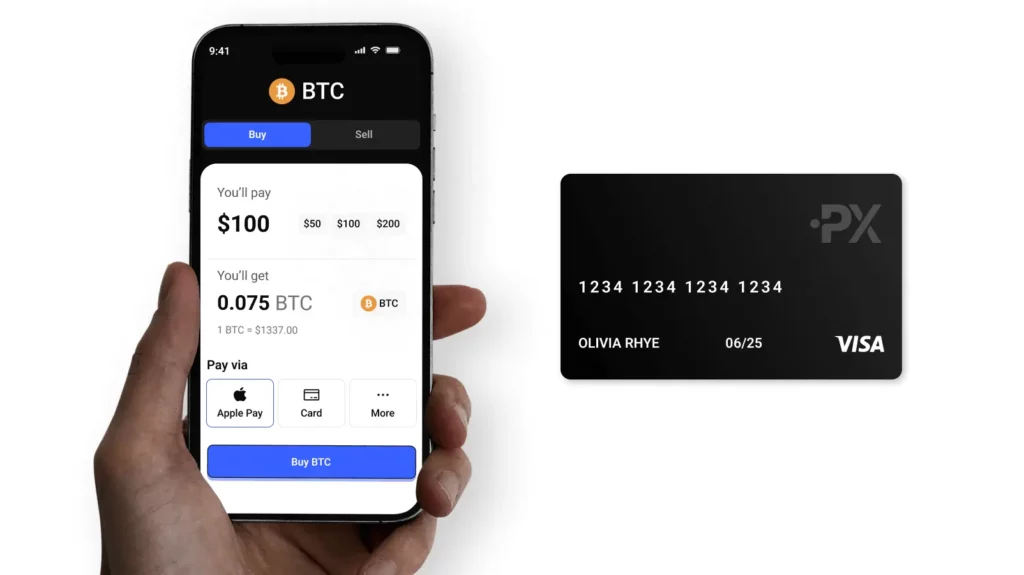

- PrimeXBT: Offers advanced trading tools, high leverage, and multiple asset classes including cryptocurrencies, forex, commodities, and indices.

In the sections that follow, we will explore the detailed features, fees, security measures, and other critical aspects of Cobinhood and PrimeXBT.

Trading Options

Both Cobinhood and PrimeXBT offer a range of trading options to cater to different trading strategies and preferences. Cobinhood’s zero-fee trading model allows traders to execute trades without incurring transaction fees, making it cost-effective. The platform supports a variety of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Litecoin.

Cobinhood provides basic trading tools suitable for beginner and intermediate traders. The platform’s interface is user-friendly, ensuring that traders can easily navigate and execute trades. Cobinhood also supports ICO (Initial Coin Offering) trading, allowing users to participate in token sales directly from the platform.

- Zero-Fee Trading: Execute trades without any transaction fees.

- Supported Cryptocurrencies: Trade popular cryptocurrencies including Bitcoin, Ethereum, and Litecoin.

- Basic Trading Tools: Suitable for beginner and intermediate traders.

- ICO Trading: Participate in ICOs directly from the platform.

- User-Friendly Interface: Simple and intuitive design for easy navigation.

PrimeXBT, in contrast, offers a comprehensive range of trading instruments, including cryptocurrencies, forex, commodities, and indices. The platform is known for its high leverage options, allowing traders to amplify their potential returns. PrimeXBT supports various order types, including market, limit, and stop orders, providing flexibility in trade execution.

- Margin Trading: Leverage up to 100x on cryptocurrencies, forex, commodities, and indices.

- Order Types: Market, limit, and stop orders for flexible trading strategies.

- Copy Trading: Follow and copy the trades of experienced traders through the Covesting module.

- Turbo Trading: High-risk, high-reward short-term trading options.

- API Access: Supports automated trading and integration with external trading bots.

PrimeXBT’s diverse trading instruments and leverage options make it suitable for traders looking to trade across different markets. Cobinhood’s zero-fee trading and user-friendly interface appeal to cost-conscious traders and beginners. Choosing the right platform depends on your trading goals and preferences.

Fee Structure

Understanding the fee structure is critical for managing trading costs and optimizing profitability. Cobinhood and PrimeXBT have distinct fee models that cater to different trading activities.

Cobinhood’s primary advantage is its zero-fee trading model. Traders can execute trades without paying transaction fees, which can significantly reduce trading costs, especially for high-frequency traders. However, Cobinhood charges withdrawal fees that vary based on the cryptocurrency being withdrawn.

- Zero-Fee Trading: No transaction fees for executing trades.

- Withdrawal Fees: Fees vary based on the cryptocurrency being withdrawn.

- ICO Fees: Fees may apply for participating in ICOs through the platform.

- Deposit Fees: No fees for depositing funds into the platform.

- Network Fees: Standard blockchain network fees apply for transactions.

PrimeXBT employs a straightforward fee structure with competitive trading fees and overnight fees. The platform charges a flat trading fee of 0.05% per trade for all asset classes. Overnight fees apply to leveraged positions held overnight, calculated based on the asset and the leverage used.

- Trading Fees: 0.05% per trade for all asset classes.

- Overnight Fees: Charged on leveraged positions held overnight, varying by asset and leverage.

- Withdrawal Fees: Fixed fees for withdrawing funds, varying by withdrawal method.

- Covesting Fees: Performance and management fees for using the Covesting module.

- Turbo Trading Fees: Specific fees associated with Turbo trading options.

Cobinhood’s zero-fee trading model makes it cost-effective for executing trades, but withdrawal fees should be considered. PrimeXBT’s flat fee structure simplifies cost calculations, making it easier for traders to manage their expenses. When choosing between Cobinhood and PrimeXBT, consider the fee structure that aligns with your trading volume and strategy.

Security and Regulation

Security is a paramount concern for traders, and both Cobinhood and PrimeXBT implement robust measures to protect user accounts and funds. However, their approaches to security and regulation differ.

Cobinhood employs advanced encryption technology and two-factor authentication (2FA) to safeguard user data and transactions. The platform also conducts regular security audits to ensure compliance with industry standards. Cobinhood’s cold storage system keeps the majority of user funds offline, reducing the risk of hacks.

- Encryption Technology: Uses advanced encryption to protect user data and transactions.

- Two-Factor Authentication (2FA): Adds an extra layer of security for account access.

- Cold Storage: Majority of funds stored offline in cold storage.

- Regular Security Audits: Ensures compliance with industry standards.

- Secure Transactions: Implements robust security measures for all transactions.

PrimeXBT also prioritizes security, offering similar measures such as 2FA, encryption, and secure asset storage. The platform employs a multi-signature withdrawal system to enhance the security of user funds. PrimeXBT has a strong track record of security, with no major breaches reported since its inception.

- Two-Factor Authentication (2FA): Enhances account security.

- Encryption: Protects user data and transactions.

- Multi-Signature Withdrawals: Uses a multi-signature system for secure fund withdrawals.

- Secure Storage: Majority of funds stored in cold wallets.

- Compliance: Adheres to global regulatory standards.

In terms of regulation, Cobinhood and PrimeXBT differ in their approaches. Cobinhood emphasizes privacy and does not require KYC (Know Your Customer) verification for basic accounts, making it accessible to users who prioritize anonymity. PrimeXBT also does not require KYC for basic accounts, but users may be required to complete KYC verification for certain features and higher withdrawal limits.

- Cobinhood: No mandatory KYC, advanced security measures, emphasis on privacy.

- PrimeXBT: No mandatory KYC for basic accounts, advanced security features, regulatory compliance for certain features.

Choosing between Cobinhood and PrimeXBT from a security and regulation perspective depends on your priorities regarding privacy and regulatory compliance. Both platforms provide robust security, but their approaches to regulation may influence your decision.

User Experience and Interface

The user experience and interface of a trading platform significantly impact a trader’s ability to navigate the platform and execute trades efficiently. Cobinhood and PrimeXBT each offer unique interfaces designed to cater to their target audiences.

Cobinhood’s interface is designed to be user-friendly, making it accessible to both beginner and intermediate traders. The platform offers basic trading tools that allow users to execute trades easily and manage their portfolios. Cobinhood’s zero-fee trading model and straightforward design make it appealing to cost-conscious traders and those new to cryptocurrency trading.

- User-Friendly Design: Intuitive interface suitable for beginners and intermediate traders.

- Basic Trading Tools: Simplified tools for easy trade execution and portfolio management.

- Zero-Fee Trading: Cost-effective trading with no transaction fees.

- ICO Trading: Participate in ICOs directly from the platform.

- Simple Navigation: Easy-to-navigate interface for efficient trading.

PrimeXBT, on the other hand, is tailored for advanced traders, featuring a clean and professional design with access to a wide range of trading tools. The platform provides detailed charts, technical indicators, and customizable layouts to enhance the trading experience. PrimeXBT’s focus on functionality makes it ideal for traders who require advanced tools and features to implement their strategies.

- Advanced Charting Tools: Detailed charts and technical indicators for in-depth market analysis.

- Customizable Layouts: Personalize the trading interface to suit your preferences.

- Professional Design: Clean and professional design focused on functionality.

- Multiple Order Types: Execute market, limit, and stop orders seamlessly.

- API Integration: Supports automated trading and integration with external bots.

PrimeXBT’s professional and customizable interface appeals to traders who need advanced tools and a high degree of control over their trading environment. Cobinhood’s user-friendly design and zero-fee trading make it accessible to beginners and cost-conscious traders. When choosing between Cobinhood and PrimeXBT, consider your level of trading experience and the type of interface that best supports your trading activities. Both platforms offer robust features, but their interface designs cater to different user needs.

Supported Cryptocurrencies and Assets

The range of supported cryptocurrencies and assets is a crucial factor when choosing a trading platform. Cobinhood and PrimeXBT both offer access to a variety of cryptocurrencies, but their offerings differ in terms of diversity and depth.

Cobinhood provides access to a wide range of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Litecoin. The platform supports trading of numerous altcoins, making it suitable for traders looking to diversify their cryptocurrency portfolios. Cobinhood also allows users to participate in ICOs, offering opportunities to invest in new and emerging projects.

- Bitcoin (BTC): Trade the most widely recognized cryptocurrency.

- Ethereum (ETH): Access the second-largest cryptocurrency by market capitalization.

- Litecoin (LTC): Trade a popular cryptocurrency known for its faster transaction times.

- Altcoins: Access a variety of altcoins for portfolio diversification.

- ICO Participation: Invest in new and emerging projects through ICOs.

PrimeXBT, in contrast, offers a comprehensive range of trading instruments, including cryptocurrencies, forex, commodities, and indices. The platform provides access to major cryptocurrencies like Bitcoin, Ethereum, and Litecoin, as well as other financial instruments, allowing traders to diversify their portfolios and trade across different markets.

- Bitcoin (BTC): Trade the most widely recognized cryptocurrency.

- Ethereum (ETH): Access the second-largest cryptocurrency by market capitalization.

- Litecoin (LTC): Trade a popular cryptocurrency known for its faster transaction times.

- Forex: Major currency pairs such as EUR/USD and GBP/USD.

- Commodities and Indices: Trade gold, silver, crude oil, and major stock indices.

PrimeXBT’s focus on major cryptocurrencies and diverse financial instruments makes it suitable for traders looking to trade across different markets. Cobinhood’s support for a wide range of altcoins and ICO participation appeals to traders interested in exploring various digital assets and new projects. Choosing the right platform depends on your trading goals and the types of assets you wish to trade.

Customer Support and Resources

Effective customer support and access to educational resources are essential for a positive trading experience. Both Cobinhood and PrimeXBT offer support and resources to assist their users, but their approaches differ.

Cobinhood provides customer support through email and a comprehensive help center. The platform offers tutorials, FAQs, and articles covering various aspects of trading on Cobinhood. Additionally, Cobinhood’s support team is available to assist users with any issues or questions they may have.

- Email Support: Contact the support team via email for detailed assistance.

- Help Center: Access tutorials, FAQs, and articles for self-help.

- Trading Guides: Detailed guides on using the platform and executing trades.

- Community Support: Engage with other traders in forums and social media channels.

- Educational Resources: Resources to help users learn about trading and the platform’s features.

PrimeXBT offers a range of support options, including email support, live chat, and a detailed help center. The platform provides extensive educational resources such as tutorials, webinars, and articles to help users learn about trading and the platform’s features.

- Email Support: Reach out to the support team for assistance via email.

- Live Chat: Get real-time support through the live chat feature.

- Help Center: Access a wide range of tutorials, FAQs, and guides.

- Webinars: Participate in webinars to learn from experts and enhance your trading skills.

- Educational Articles: Explore in-depth articles on various trading topics and platform features.

PrimeXBT’s focus on direct support and comprehensive guides ensures that users can quickly find answers and resolve issues. Cobinhood’s educational resources and community support provide additional learning opportunities for traders looking to expand their knowledge and skills.

When selecting between Cobinhood and PrimeXBT, consider the type of support and resources that best meet your needs. Both platforms offer robust support, but their approaches to education and customer assistance may influence your choice.

Cobinhood vs PrimeXBT: Pros and Cons

To summarize the comparison, here are the pros and cons of Cobinhood and PrimeXBT, highlighting the strengths and potential drawbacks of each platform.

Cobinhood

- Pros:

- Zero-fee trading model for cost-effective transactions.

- User-friendly interface suitable for beginners and intermediate traders.

- Access to a wide range of cryptocurrencies, including altcoins.

- Opportunities to participate in ICOs directly from the platform.

- Strong emphasis on privacy with no mandatory KYC.

- Cons:

- Basic trading tools may not meet the needs of advanced traders.

- Limited support for traditional financial instruments like forex and commodities.

- Withdrawal fees vary based on the cryptocurrency being withdrawn.

- Less focus on advanced trading features and tools.

PrimeXBT

- Pros:

- Advanced trading tools and high leverage options.Access to multiple asset classes including cryptocurrencies, forex, commodities, and indices.

- Professional and customizable interface.

- Flat and transparent fee structure.

- Emphasis on privacy with no mandatory KYC for basic accounts.

- Cons:

- Limited selection of cryptocurrencies compared to Cobinhood.

- May be complex for beginners due to advanced tools.

- Less focus on educational resources and community engagement.

- Overnight fees apply to leveraged positions held overnight.

Feature Comparison of Cobinhood vs PrimeXBT

The table below provides a detailed comparison of the key features offered by Cobinhood and PrimeXBT. This comparison highlights the differences and similarities to help traders choose the most suitable platform for their needs.

| Feature | Cobinhood | PrimeXBT |

|---|---|---|

| Leverage | None | Up to 100x |

| Trading Fees | Zero fees | 0.05% per trade |

| Supported Cryptocurrencies | Wide range including altcoins | Major cryptocurrencies (BTC, ETH, LTC) |

| Order Types | Market, Limit | Market, Limit, Stop |

| Copy Trading | No | Yes, through Covesting |

| Security Features | Encryption, 2FA, Cold Storage | Encryption, 2FA, Multi-Signature Withdrawals |

| KYC Requirements | No mandatory KYC | No mandatory KYC for basic accounts |

| Fiat Support | No direct fiat support | No direct fiat support |

| Mobile App | Yes | Yes |

| Customer Support | Email, Help Center | Email, Live Chat, Help Center |

| Educational Resources | Tutorials, FAQs, Articles | Webinars, Tutorials, Articles |

| Additional Features | ICO Participation | Turbo Trading, API access |

This table provides a clear comparison of the features offered by Cobinhood and PrimeXBT, helping traders make an informed decision based on their specific trading needs and preferences.

FAQs About Cobinhood vs PrimeXBT

Here are some frequently asked questions about the comparison between Cobinhood and PrimeXBT, providing additional insights to help users make informed decisions.